How is a corporate PPA priced in a volatile environment?

Spiralling energy prices have put PPAs on the map as a tool for corporates to mitigate market risks. But pricing PPAs is as tricky as ever. Pexapark, a PPA software solutions and advisory firm, hopes to shed some light on this burning topic with some key facts every corporate should bear in mind about PPA pricing.

The corporate PPA market across Europe is going from strength to strength. From its early days around five years ago, the list of corporates signing up to green energy and the countries facilitating these agreements has grown significantly.

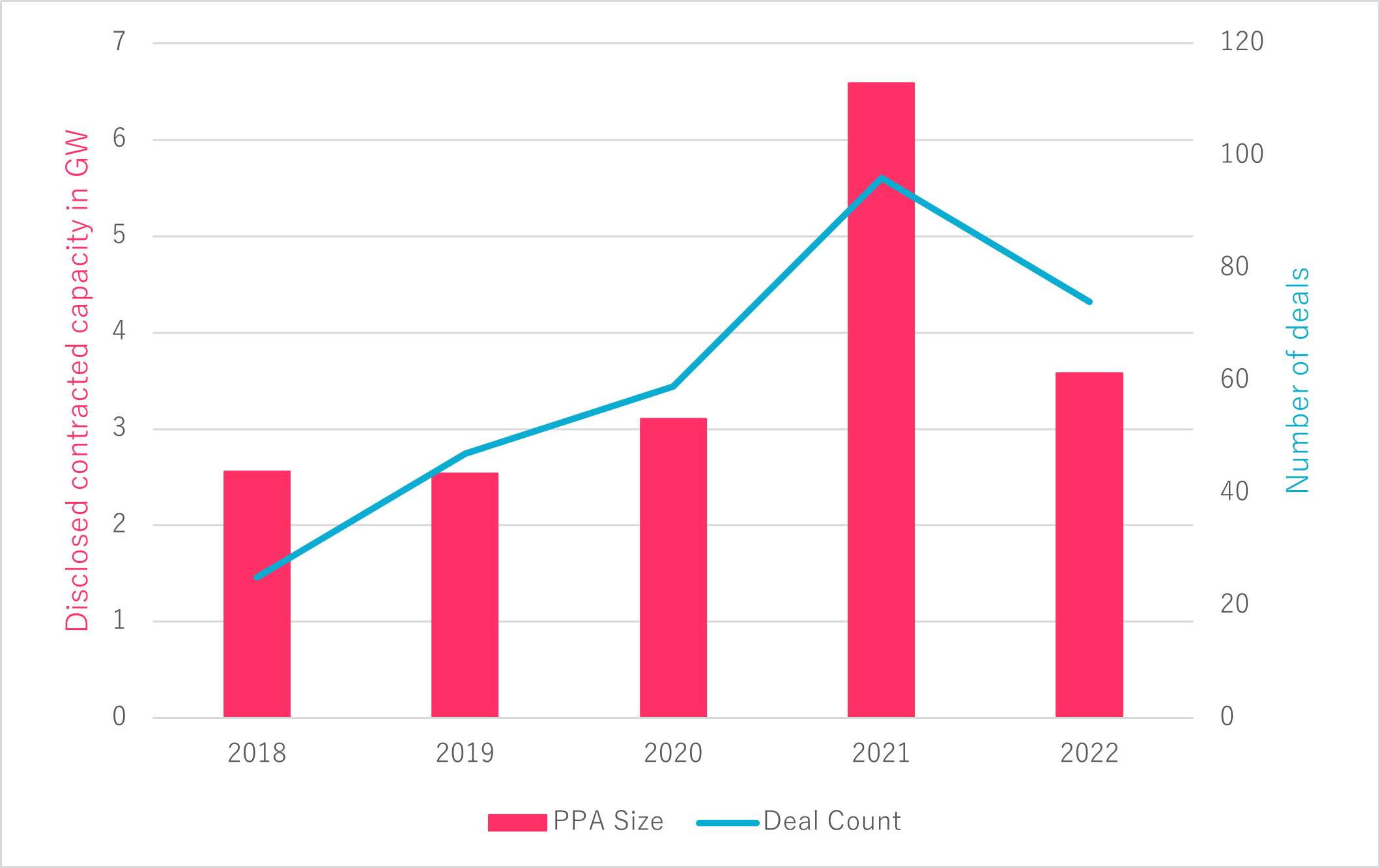

European corporate PPAs by contracted capacity and deal count, 2018- August 2022

Despite the unprecedented energy situation, activity in 2022 has continued at a respectable pace, but disclosed contracted capacity seems to be decreasing. But there are still four months to go to have a complete picture. Up until August [2022], Pexapark’s PPA Tracker recorded 74 corporate deals worth 3.6GW in disclosed capacity.

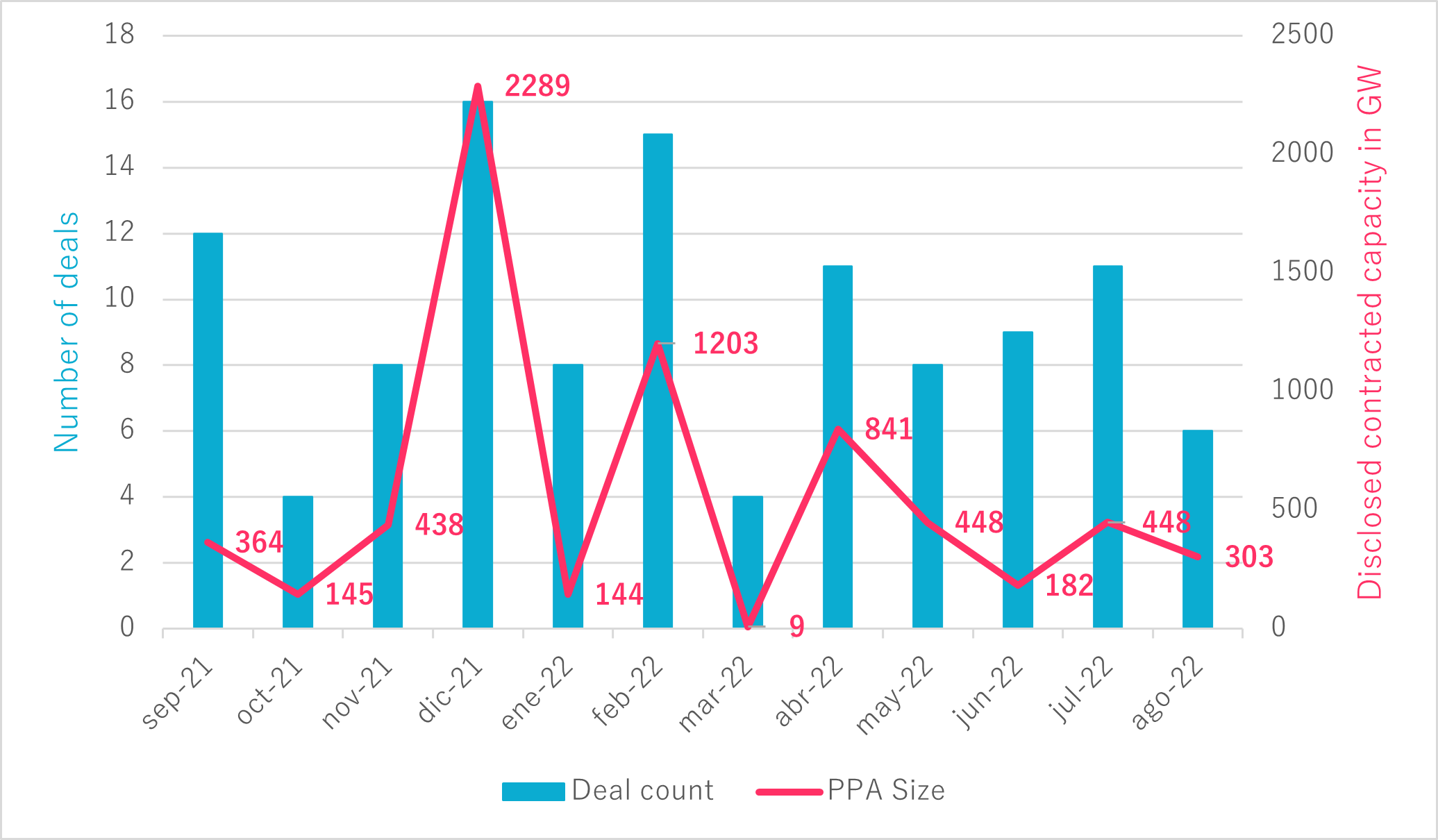

12-month rolling activity by contracted capacity and deal count

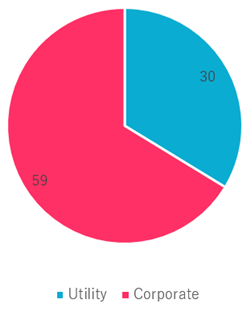

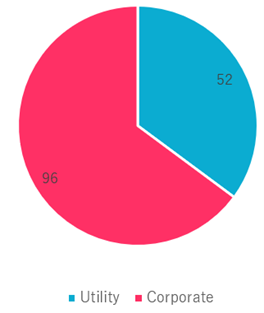

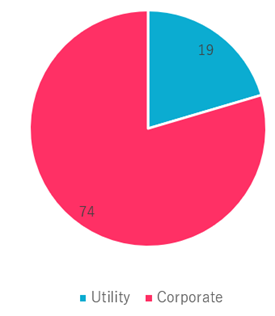

Corporates have dominated the PPA market for some time now, but in 2022 this dominance became proportionally clearer. The pie charts below highlight activity by deal count.

There’s a clear reason why utilities have reduced offtake activity in 2022 – the extraordinary rise in energy prices that Europe has seen over the past year. And in Pexaparks case there’s a much stronger corporate appetite for affordable green energy than what the actual signed deals might suggest.

The reason for these developments has to do with the risks of PPA pricing. One might assume that the rise in power prices would benefit the PPA market because corporate buyers would be eager to hedge against further increases. And that’s partially true. The will is there, but the challenges are daunting. Let’s take a broad look at why this is.

Why can PPAs be tricky in a high-pricing and volatile environment?

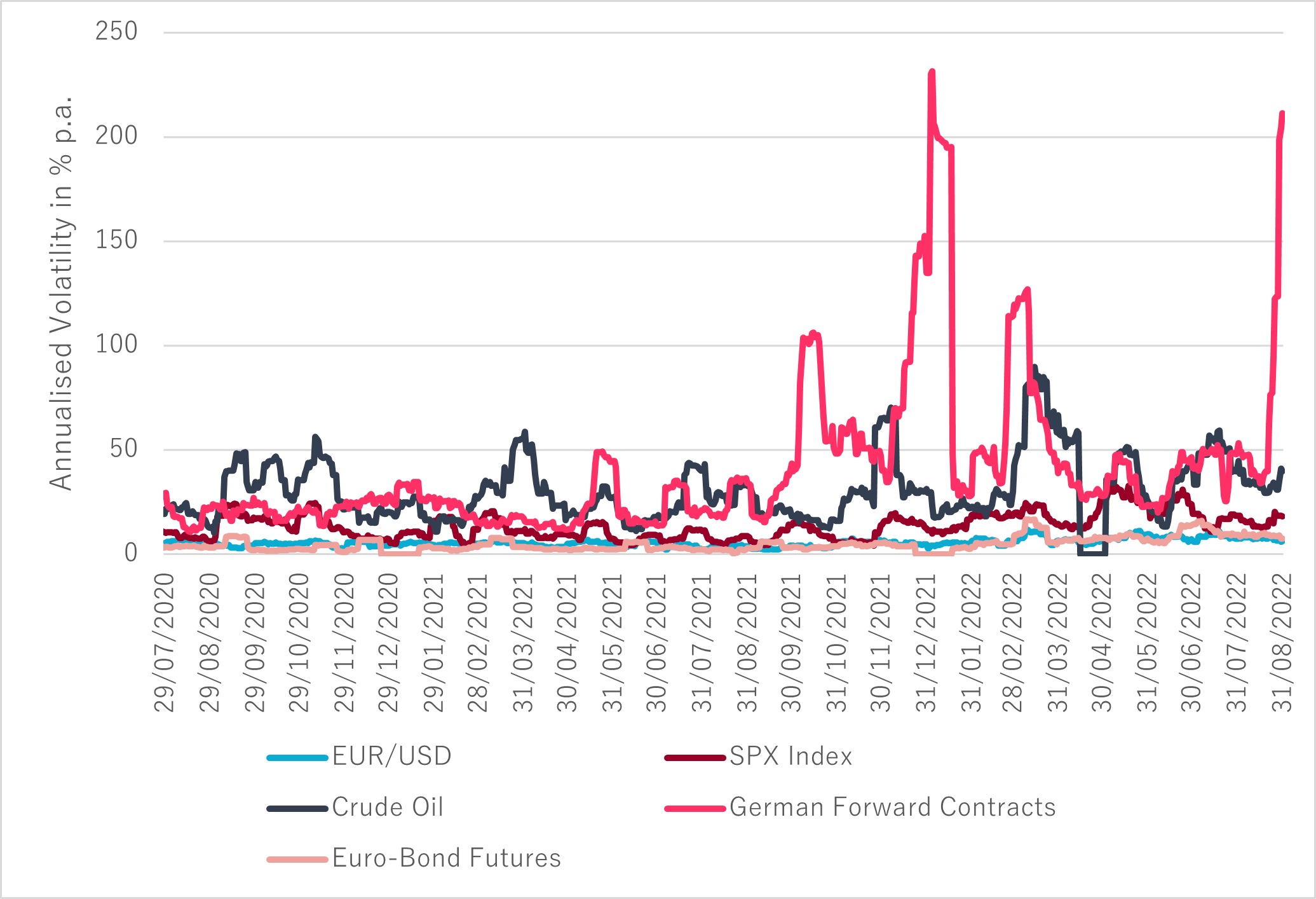

Volatility – the day-to-day percentage change in a commodity’s price – is a massive hurdle of its own. Given the nature of energy commodities, this high volatility is an accepted risk compared with other commodities. But volatility over the past year has reached record levels. The German 1-year forward (Cal23) contract for example peaked at a turbulent 230% volatility percentage.

Annualised realised volatility across asset classes, August 2020- August 2022

This has a number of implications – most importantly, the long-term pricing risk is now much greater. For most corporate offtakers, long-term price risk has always been a challenge. Energy-intensive industrials have usually procured energy for the foreseeable future, in the range of 1-3 years. This is because energy prices are a core element of their production cost, so the internal risk mandates are very cautious.

A PPA is a contractual arrangement between a buyer and a seller for an agreed amount of energy at a negotiated price per MWh. PPAs are usually for a fixed price, over a tenor of up to 25 years. The most popular tenor in the European PPA market has been the 10-year PPA, which crucially is different from the 1-3 year horizon.

To this end, corporate PPAs serve multiple purposes. They can boost an entity’s green credentials, and also act as a safeguard for pricing certainty and stability. A PPA can also potentially act as an effective pricing hedge. And while the last two points look identical, there is a subtle difference.

Price hedging, as the name suggests, is about limiting exposure to price fluctuations. But there is an inherent assumption that it limits the risk of ‘adverse and unfavourable pricing movements’. For many buyers, price hedging can seem like an attractive form of bulletproof protection from damaging price changes. When it comes to electricity procurement, only high or higher than average industry exposure could have ‘damaging’ effects. The buyer themselves shouldn’t be harmed if prices fall, right?

If the price of a 10-year PPA today ends up being above market price in two years’ time, the buyer will end up overpaying. Who knows how prices will evolve over a 10-year tenor? But regardless, it offers stability and all the perks that come with it.

In a high-pricing environment, the market value of electricity has gone up significantly, and increases are visible all along the curve. And so the high value of electricity has increased benchmark PPA prices. But volatility means that this could change at any time. This is why even if corporate appetite is high, PPA deal-making continues apace when price changes are moderate – because pricing risk is easier to manage.

On a positive note, there are still ways to proceed with a PPA. Baseload prices are not the only element of PPA pricing. Rather it’s all about understanding the risks and enhancing negotiation power with sellers.

How a PPA is priced

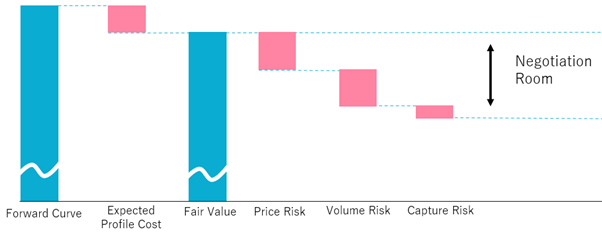

Long-term PPA prices are influenced by a few key factors. In effect, there are two major groups of elements. First, the ones defining the market-based fair value of the PPA and second, the discounts applied based on risk allocation and individual appetite.

Market-based fair value

One of the biggest factors in PPA pricing are current baseload prices – that is the value of electricity today. The tool used for this purpose is the forward curve, which is set daily based on the price of the trades between buyers and sellers for future delivery periods. As the liquidity of trades in the forward markets is usually no more than five years (and between 1-3 in illiquid markets), there’s not much market-based visibility in what the value of the energy purchased today will be like in 10-years’ time.

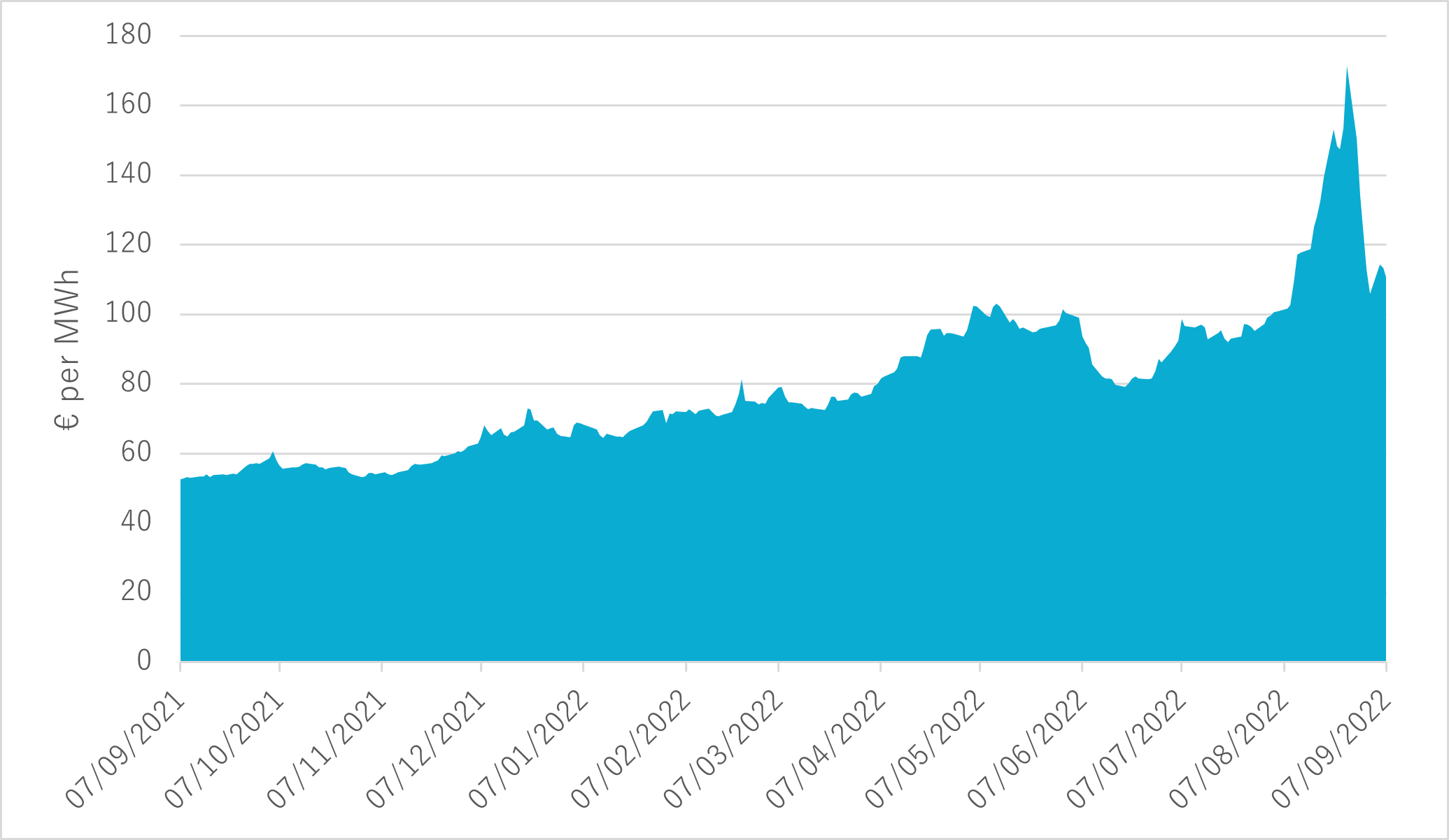

Forward curves, together with an extrapolation algorithm for non-observable prices, are Pexapark’s main element for its fair-value benchmark PPA prices. Against the current high-price backdrop, Pexapark’s Euro Composite Index (the weighted average of all countries and technologies) for 10-year Pay-as-Produced (PAP) PPAs grew by 110% (€52.51 on 7 Sept 2021 and €110.79 on 7 Sept 2022).

PEXA Euro Composite, September 2021-September 2022

After corporates factor in the forward curve, they need to calculate expected profile costs – that is the cost of matching its baseload consumption with the offtake profile. Depending on the volume structure, they may end up having to go to the market to procure outstanding electricity needs. This is always the case with a Pay-as-Produced PPA, for example. According to Pexapark, after these first steps you will have a reliable view of the fair value of PPAs.

Risk components

The fair value based on the forward curve and the profile cost is just the start of the pricing journey, however. What comes next are the applied discounts based on the risks each PPA carries.

First, as mentioned above, is the price risk. How much do you ‘charge’ for the uncertainty of committing to a fixed-price which could be higher than market prices in the future? The price risk needs to be clearly reflected in the final PPA price.

Second, there’s the volume risk to consider, especially when there are minimum fixed energy deliveries as part of the arrangement. What are the chances of the plant producing as forecasted? And who carries the risk if there are production/delivery setbacks?

And most importantly, there is the cannibalisation risk, which is the long-term effect of capture risk. Cannibalisation occurs when a lot of intermittent renewables with the same generation profile are producing at the same time, dragging down the wholesale price. In a PAP volume structure, this risk mostly lies with the offtaker. If the value of the energy you will buy in a few years has fallen due to cannibalisation, there’s a discount to be applied from the offtaker’s side.

If PPA components aren’t valued correctly, companies could end up in a difficult situation. On the one hand, there’s the risk of onboarding excessive risks. On the other hand, being too conservative means that you could lose out on opportunities and be priced out of the market. PPAs are all about risk allocation, so risks need to be understood and priced correctly.

What corporate buyers can do

Despite the challenging environment, new PPAs are being signed every month. Interested corporate buyers are able to achieve the optimal risk/reward balance and to reach their procurement objectives with the right approach. With that in mind, here is some advice:

• Utilities have practically invented risk-based PPA pricing methodology and have the technology to track and value PPA prices. Generators and investors have followed suit, becoming ‘next generation utilities’ – sellers with utility-grade capabilities to manage electricity markets. As corporates aim to dominate the PPA market, they are the most recent recruits in deciphering the secrets of PPA pricing. Getting familiar with electricity markets and quantifying long-term risks to get the most out of a PPA are key milestones in setting out a procurement strategy.

• The volatile environment has re-calibrated the long-term appetite of both buyers and sellers. Look at different tenors for your PPA. The 10-year PPA is no longer the absolute prerequisite for the bankability of a project. There has been a rise in the number of short-term PPAs, and project investors are beginning to accept them as well.

• If you’re badly in need of affordable green energy, waiting for new projects is probably not the wisest choice at the moment. Depending on regulatory factors, some existing projects can opt out of their subsidy scheme fairly easily. This is the case for renewable plants under Germany’s EEG scheme. These projects offer a wider range of options in terms of tenor, since there’s no greenfield financing involved.

• If you’re running a RfP process, quantitatively assessing the bids based on the value they offer is key. Remember: value and price can be different! The value each bid offers varies depending on the risks that each seller prices into their bid. This can be different whether they are a utility or a project owner. We’ve explained the process in more detail in our guide on cross-border PPAs here.

Meet us at RE-Source 2022 in Amsterdam for more info! Pexapark’s Head of Advisory Jens Hollstein will take part in the ‘PPA Pricing Strategies’ panel, on Thursday 6 October. Pexapark will also be hosting an Academy for corporate buyers, so feel free to join us for unique 1-1 chats with our experts!