We are living through an incredibly exciting time in renewable energy procurement. Now, more than ever before, it is important to understand how PPAs and other forms of corporate sourcing can help to make your electricity supply greener, cheaper and more efficient. This is why RE-Source has put together this brief explanation on the what, why and how of corporate sourcing.

What is corporate sourcing and what are PPAs?

Corporate sourcing of renewables is a rapidly growing trend across Europe. Driven by sharp cost reductions, combined with growing calls for sustainability among investors and consumers, renewable energy has become an attractive investment for companies around the world.

The potential for the renewable corporate sourcing market in Europe, which includes both power purchase agreements (PPAs) and other forms of corporate sourcing, is significant. Globally, corporate sourcing has added over 100GW to the grid, through corporate PPAs or direct onsite installations. PPAs and other tools are therefore a crucial route to the market for renewables, as well as a beneficial option for corporates.

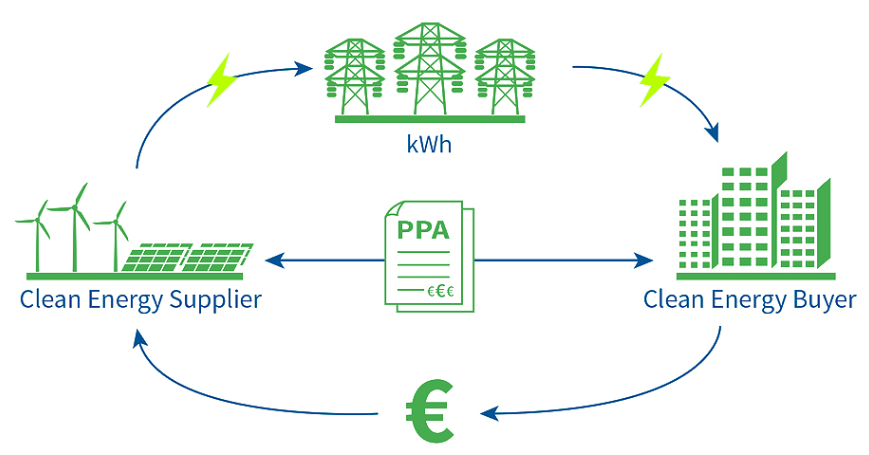

A corporate PPA is an upfront contractual agreement between a buyer and a seller for the exchange of an amount of electricity from a renewable generator for an agreed price (fixed or market-related). These agreements usually last between 5-20 years. Starting in earnest in 2014, the corporate PPA market in Europe has continued to grow year on year. Current trends show an even spread of wind and solar contracted, and increasing renewables portfolios to cover corporate energy loads effectively and take advantage of the complementarity of solar, wind and storage.

Why is corporate sourcing taking off?

Across the world, there is an urgent need for new energy flows from secure sources. The world is also becoming more electrified. Crucially, corporates want to play their part in limiting global warming, by sourcing cheap, clean electricity to reduce Scope 2 emissions. Renewable corporate sourcing was developed to help realise these aims.

Many companies have committed to a 100% renewable electricity supply globally (through the RE100 initiative), and corporate sourcing has become a major business opportunity, boosting the economic competitiveness of corporates and reducing their carbon footprint.

Why should I be interested in corporate sourcing?

Lowering and fixing costs

Corporate PPAs allow companies to pay a fixed price for energy over a period of years, reducing electricity cost volatility and generating savings on energy bills over the long term.

Decarbonisation

PPAs and other forms of corporate sourcing allow an efficient and affordable way for companies to lower their GHG emissions and access reliable renewable energy.

Corporate social responsibility

Corporate sourcing allows your business to show its social awareness and positive impact in the community.

Learn more about corporate sourcing by visiting the Renewable Energy Buyers Toolkit.

Reviews from users of the Buyers Toolkit