The difference between pricing and valuing a corporate PPA

Disclaimer: This report was produced by Pexapark. PPA data collected by RE-Source and Pexapark may differ slightly

Hedging against volatility has become the primary motivation behind corporates pursuing PPA agreements. But pricing is as tricky as ever, with the recent turmoil having resulted in some signed long-term PPAs well above market value.

Pexapark, a specialist price intelligence, software and advisory services provider in renewable energy, hopes to shed some light on the topic with key facts every corporate should consider on the difference between pricing vs valuing PPAs.

The corporate PPA market across Europe is going from strength to strength. From its early days around six years ago, the list of corporates signing up for green energy and the countries facilitating these agreements has grown significantly.

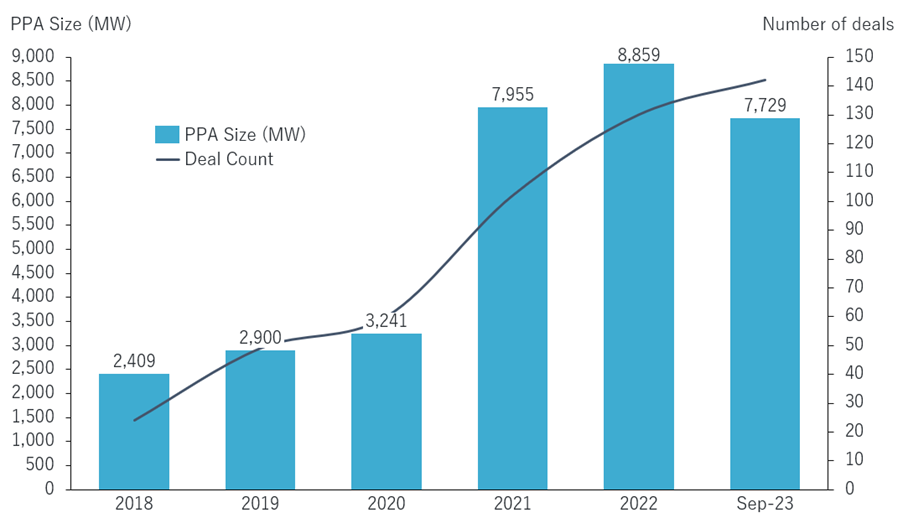

European corporate PPAs by contracted capacity and deal count, 2018- September 2023

Source: PPA Tracker, PexaQuote Note: Chart excludes Utility PPAs. Only long-term PPAs with >5-year tenor included in the analysis.

In 2022, amid an unprecedented energy pricing crisis, corporates held the fort of the European PPA market, and signed a record 130 long-term deals totalling at least 8.8GW of disclosed contracted volumes. In 2023, the force of corporates has continued, with the deal count already amounting to 142 long-term PPAs.

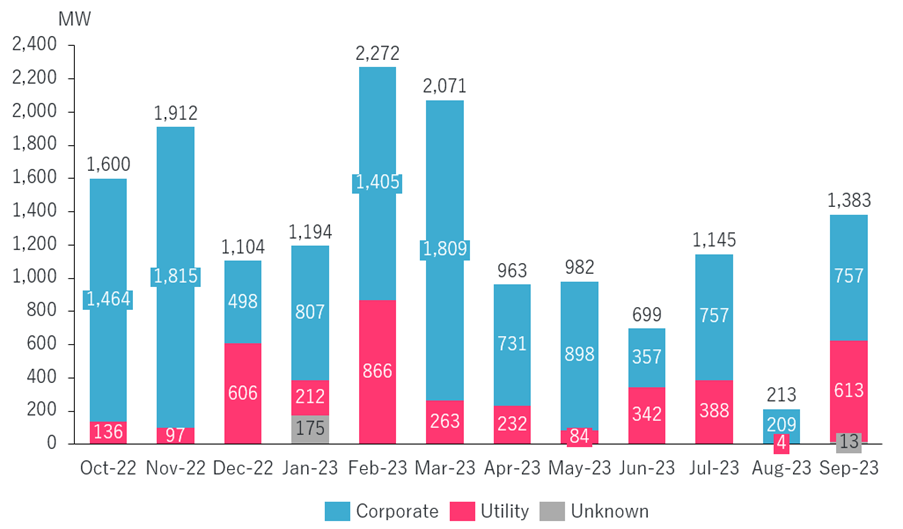

Breakdown of 12-month rolling activity by offtake type and contracted capacity

Source: PPA Tracker, PexaQuote Note: Only long-term PPAs with >5-year tenor included in the analysis.

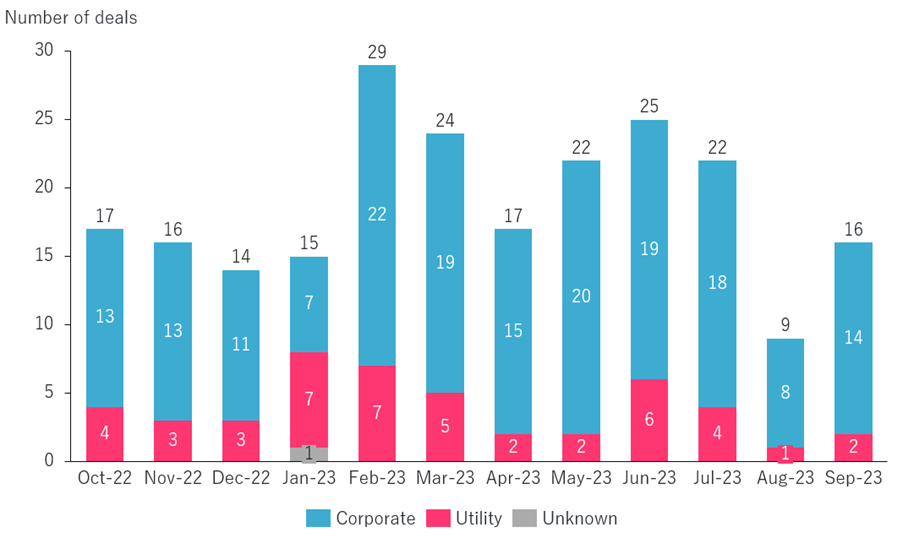

Breakdown of 12-month rolling activity by offtake type and deal count

Source: PPA Tracker, PexaQuote Note: Only long-term PPAs with >5-year tenor included in the analysis.

Corporates have dominated the PPA market for some time now, but in 2022 this dominance became proportionally clearer. In 2023, the trend continues, but due to decreased market risks, utilities – which often act as the middleman between projects and corporates – have notably increased their participation in the market.

The reason for decreased utility offtakes in 2022 was no other but the risks of PPA pricing. An important-to-understand fact is that pricing depends on the risk impact on the PPA offtaker.

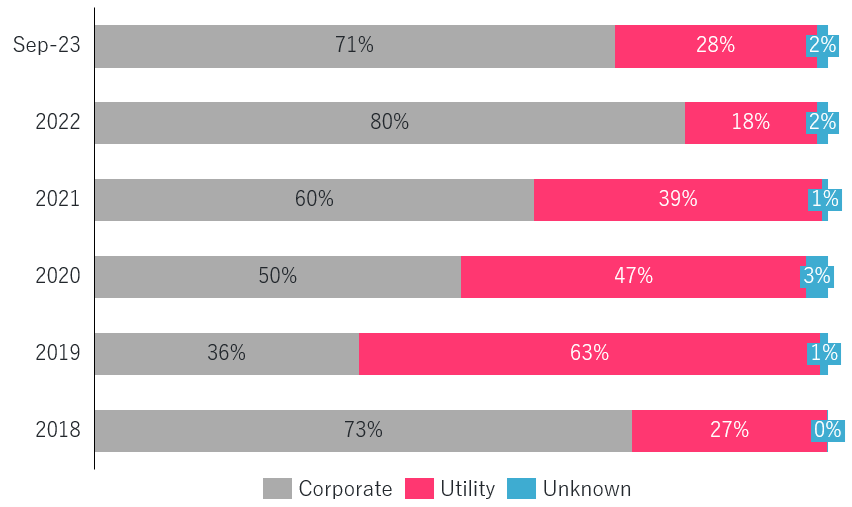

Breakdown of contracted PPA volumes by offtake segment, 2018- Sept 2023

Source: PPA Tracker, PexaQuote

For utilities and traders, entering a PPA will give rise to considerable non-hedgeable risk such as volume and cannibalization (capture). In order to buffer against such risk, traders will bid at discounted prices, resulting in transaction prices well below the expected market price of contracted volumes.

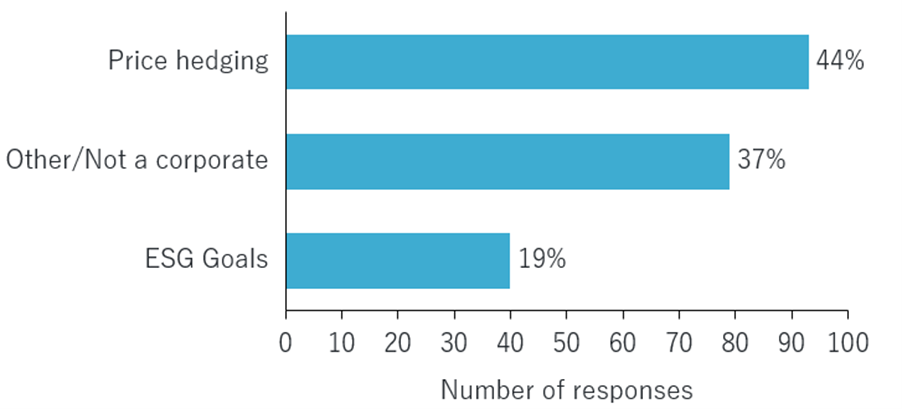

In stark contrast, corporate offtakers, many of which have been shaken by the extreme price surges during the European energy crisis which has increased their price hedging appetite, see a benefit in price stability, pricing PPAs well above the levels which traders are willing to pay. That’s because corporates have been interested in closing PPAs to reduce their energy price risk and are often not sophisticated enough to take an advanced view on how the market will evolve and, therefore, price discounts utilities are seeing, such as price cannibalization due to the large increase in renewable penetration. .

Q: What is the main driver of PPA interest in your organisation? Note: Question answered on a ‘single answer’ basis by 212 respondents.

Source: Participant poll at Pexapark’s ‘Corporate Decarbonisation: Understanding the role of the PPA Market’ webinar in September 2023

Among other reasons, it’s also due to the more aggressive PPA bids that the market share of corporates in PPA markets swung to an 80/20 in favour of corporates in 2022. One might assume that the rise in power prices would benefit the PPA market because corporate buyers would be eager to hedge against further increases. And that’s partially true. However, at Pexapark we have already seen some corporates that signed PPAs at historically high prices attempting to re-negotiate these agreements in the aftermath of the market turmoil.

As will be depicted later in this article, many corporate offtakers are eager to explore the benefits of risk-adjusted reference PPA valuing methodologies to ensure that they get a fair price for their commitment, in an attempt to obtain prices similar to those transacted by utilities. Making use of reference PPA prices means that they can distinguish the expected value vs the fair value of the PPA. The difference lies in how non-observable risks are taken into account. But let’s shed some light into the details behind the concept.

Why volatility makes PPA pricing tricky

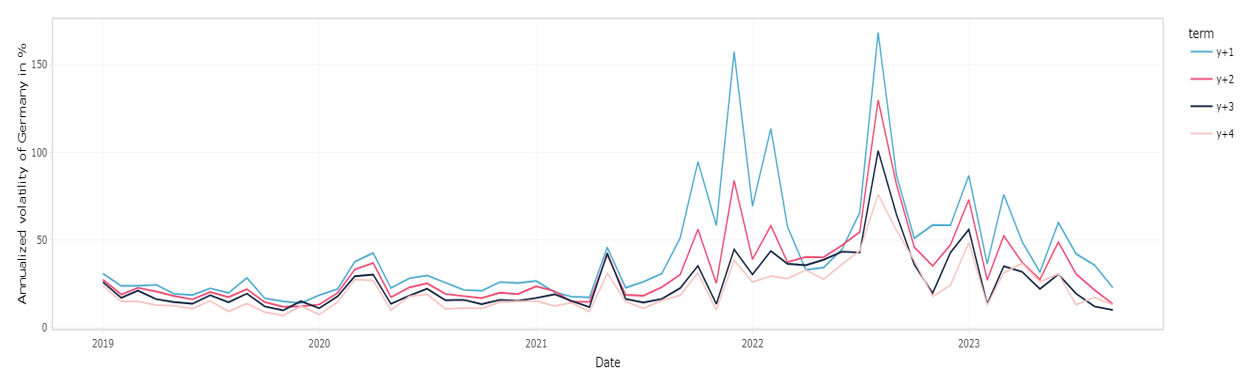

Annualised realised volatility in German electricity futures 1-4 years ahead, 2019- September 2023

Source: Pexapark

Volatility goes up with the lift and down with the stairs. This has a number of implications – most importantly, how market risks are priced.

For most corporate offtakers, long-term price risk has always been a challenge. Energy-intensive industrials usually procure energy for the foreseeable future, in the range of 1-3 years. This is because energy prices are often a core element of their production cost, so the internal risk mandates are very cautious.

Long-term corporate PPAs act as a safeguard for pricing certainty and stability, but also potentially as an effective pricing hedge. And while these two points look identical, there is a subtle difference.

Price hedging, as the term suggests, is about limiting exposure to price fluctuations. But there is an inherent assumption that it limits the risk of ‘adverse and unfavourable pricing movements’. But how can one know how prices will evolve over a 10-year tenor? Price risk reflects how much buyers need to ‘charge’ for the uncertainty of committing to a fixed price which could be higher than market prices in the future.

Second, there’s the volume risk, especially when there are minimum fixed energy deliveries as part of the arrangement. What are the chances of the renewable plant producing as forecasted? And who carries the risk if there are renewable production/delivery setbacks?

Very importantly, one of the most prevalent risks across the renewables and PPA markets is capture risk, which is the result of cannibalization risk. Cannibalization occurs when a lot of intermittent renewables with the same generation profile are producing at the same time, dragging down the wholesale price. In a Pay-as-Produced (PAP) volume structure, this risk mostly lies with the offtaker. If the value of the procured energy is set to decrease due to cannibalization, there’s a discount to be applied from the offtaker’s side.

In a turmoil environment, electricity spot and futures prices go up significantly. But volatility means that this could change at any time. PPA prices should not only reflect the baseload value of electricity, but also the risk discounts based on price, volume and capture risk.

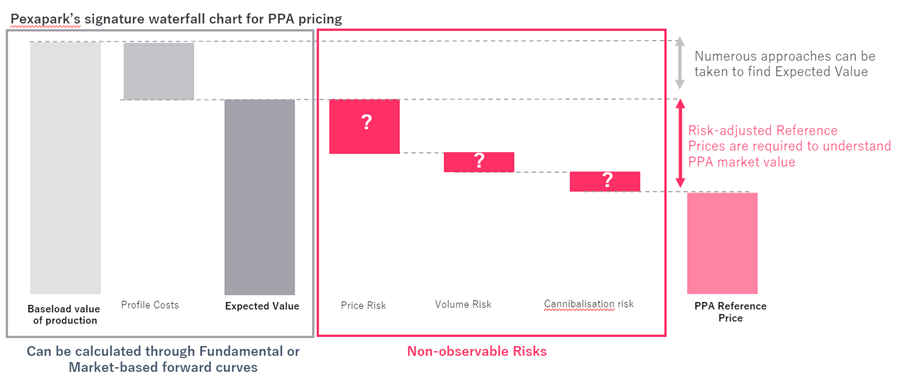

In other words, pricing a PPA based on the expected baseload energy value is different to valuing a PPA based on the non-observable risks in price, volume and cannibalization.

Difference between Pricing vs Valuing PPA prices

The term ‘pricing’ and ‘valuing’ PPAs are often used interchangeably, but at Pexapark we believe that there’s a difference, which comes down to the price assessment methodology used. When required to take a view of a PPA’s pricing, there are multiple tools and methods available in the industry.

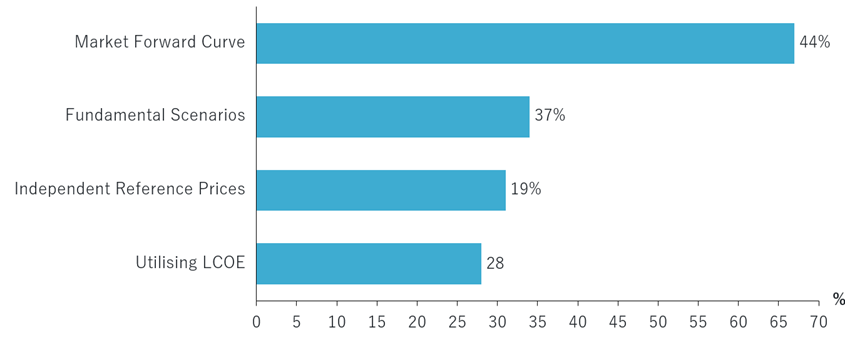

In a poll we conducted as part of a recent webinar, the majority of corporate buyers that participated stated the use of market-forward curves based on daily traded forward power contracts as a primary tool to develop a long-term view on pricing. Following came the use of fundamental scenarios, which depict a scenario-based approach of forecasting spot prices. Independent reference prices follow suit as an upcoming sought after approach, and LCOE-based pricing came last.

What tools do you use for PPA pricing? Note: Question answered on a ‘select all that applies’ basis by 190 respondents.

Source: Participant poll at Pexapark’s ‘Corporate Decarbonisation: Understanding the role of the PPA Market’ webinar in September 2023

Both market-forward curves and fundamental scenarios are able to reveal the expected value of a PPA, which is a fundament view of what the future could look like. Such tools can be used as the first step towards pricing a PPA. To move towards risk-adjusted valuation of a PPA, the non-observable Holy Trinity risks of price, volume and cannibalization needs to be taken into consideration in order to understand where the market stands. Benchmark prices with a robust methodology are able to reveal that. The price of a PPA (market-based forward curve and/or fundamental curves) does not necessarily illustrate the value of the PPA (risk-adjusted reference prices), and that’s the number one reason of misalignment on pricing expectations between parties.

The two steps are able to work hand-in-hand. In essence, the suggested starting point of to enter the negotiation room needs to be:

Expected Value – Non-observable Market Risks = PPA Price (fair value)

What corporates should do

In order to sign a fairly priced PPA, corporate buyers need to achieve the optimal risk/reward balance and approach their procurement objectives with the right tools. With that in mind, here is some advice:

- Utilities have practically invented risk-based PPA price valuation. Generators and investors have followed suit adopting utility-grade capabilities to manage electricity markets. As corporates dominate the PPA market, they are the most recent recruits in deciphering the secrets of risk-adjusted PPA reference pricing. Accessing reference PPA prices underpinned by a robust trusted methodology inherently quantifying long-term risks is a key milestone when setting out a procurement strategy.

- The volatile environment has re-calibrated the long-term appetite of both buyers and sellers. Depending on price risk appetite, look at different tenors for your PPA. In some cases, the 10-year PPA is no longer the absolute prerequisite for the bankability of a project. There has been a rise in the number of short-term PPAs, and project investors are beginning to accept them as well.

- If you’re running a RfP process, quantitatively assessing the bids based on the value they offer is key. Remember: value and price can be different! The value each bid offers varies depending on the risks that each seller prices into their bid. This can be different depending on whether the seller is a utility or a project owner.

Pexapark provides independent and neutral PPA reference prices for specific contract structures, markets, tenors, start dates and technology, providing over 1’000 PPA prices updated on a daily-basis.

Pexapark collects market transactions, feedback from market participants and over 400 monthly price points from large utilities, industrials & traders to provide an understanding of the risk-adjustment from expected value of a PPA, allowing market participants to gain price transparency in a market that only has a small number of publicly disclosed PPAs per year.

About RE-Source

RE-Source Platform represents a committed group of corporate renewable energy buyers and energy suppliers driving forward corporate renewable energy sourcing in Europe. Our mission is to make it easier for companies to use more renewable energy.